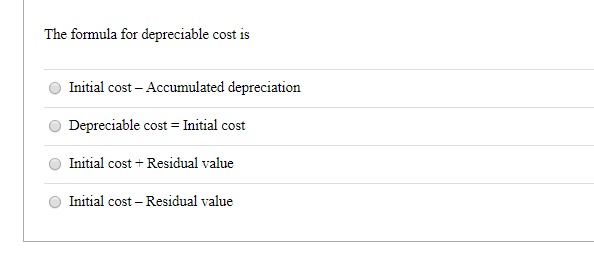

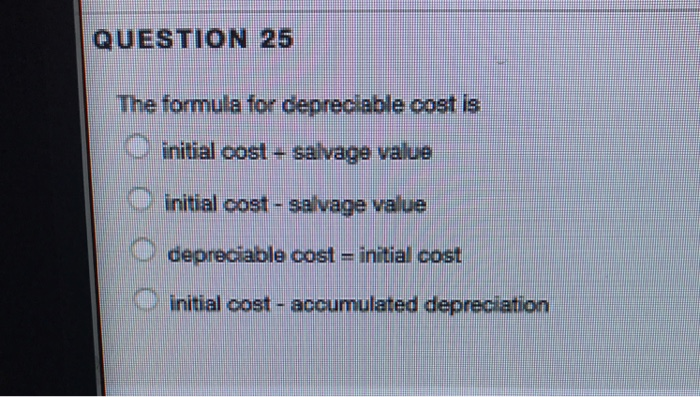

42 the formula for depreciable cost is

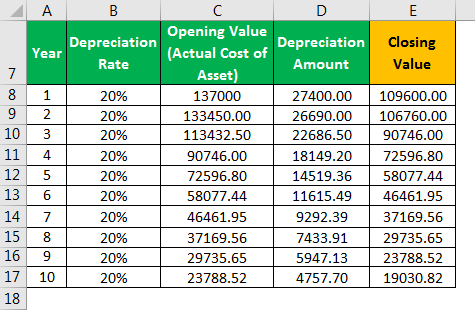

› businesses › cost-segregation-atgCost Segregation ATG Chapter 6 2 Change in Accounting Method ... A change in the treatment of an asset from non-depreciable or non-amortizable to depreciable or amortizable, or vice versa, Treas. Reg. § 1.446-1(e)(2)(ii)(d)(2); A correction to require depreciation in lieu of a deduction for the cost of depreciable or amortizable assets that had been consistently treated as an expense in the year of purchase ... › businesses › cost-segregation-auditCost Segregation Audit Techniques Guide - Chapter 5 - Review ... In the case of an acquisition including a combination of depreciable and non-depreciable property for a lump sum (e.g., buildings and land), the basis for depreciation cannot exceed an amount which bears the same proportion to the lump sum as the value of the depreciable property at the time of acquisition bears to the value of the entire ...

Solved The formula for depreciable cost is? | Chegg.com 100% (2 ratings) The formula for depreciable cost is, Depreciable cost = initial …. View the full answer. Previous question Next question.

The formula for depreciable cost is

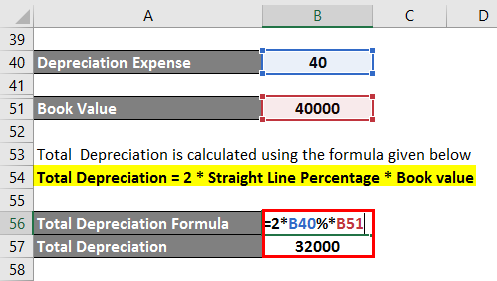

Double-Declining Depreciation Formula • The Strategic CFO Jul 23 Back To Home Double-Declining Depreciation Formula. See Also: Double-Declining Method Depreciation. Double-Declining Depreciation Formula. To implement the double-declining depreciation formula for an Asset you need to know the asset's purchase price and its useful life.. First, Divide "100%" by the number of years in the asset's useful life, this is your straight-line ... Ch 10 Quiz Flashcards | Quizlet Depreciable Cost = Initial Cost c. Initial Cost - Accumulated Depreciation d. Initial Cost - Residual Value d. the units-of-activity method When the amount of use of a fixed asset varies from year to year, the method of determining depreciation expense that best matches allocation of cost with revenue is a. the double-declining-balance method Solved 1.All of the following are needed for the ... - Chegg 2.The calculation for annual depreciation using the units-of-activity method is a. (Depreciable Cost/Yearly Output) × Estimated Output b. (Initial Cost/Estimated Output) × Actual Yearly Output c.Depreciable Cost/Yearly Output d. (Depreciable Cost/Estimated Output) × Actual Yearly Output 3.The formula for depreciable cost is

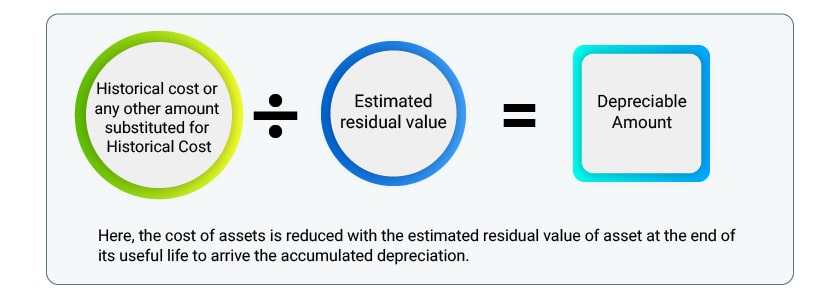

The formula for depreciable cost is. depreciable cost definition and meaning | AccountingCoach depreciable cost definition. The amount of an asset's cost that will be depreciated. It is the cost minus the expected salvage value. For example, if equipment has a cost of $30,000 but is expected to have a salvage value of $3,000 then the depreciable cost is $27,000. Depreciable Cost: What Does Depreciable Cost Mean? Depreciation cost = Purchase price of an asset - Cumulative depreciation Depreciation expense or depreciation costs is the amount of depreciation that is reported on the income statement. It's allocated portion of the cost of the fixed assets of a business that is appropriate for the accounting period The formula to compute annual straight-line depreciation is: The formula to compute annual straight-line depreciation is: Select one: a. Depreciable cost divided by useful life in units. b. (Cost minus salvage value) divided by the useful life in years. c. (Cost plus salvage value) divided by the useful life in years. d. Cost multiplied by useful life in years. Depreciated Cost - Overview, How To Calculate ... Thus, at the end of 2019, the accumulated depreciation is $14,250 ($4,750 * 3), and the depreciated cost is $95,750 ($110,000 - $14,250). At the end of the useful life of the asset, the accumulated depreciation will be $95,000 ($4,750 * 20). The depreciated cost will be $15,000 ($110,000 - $95,000), equal to the salvage value .

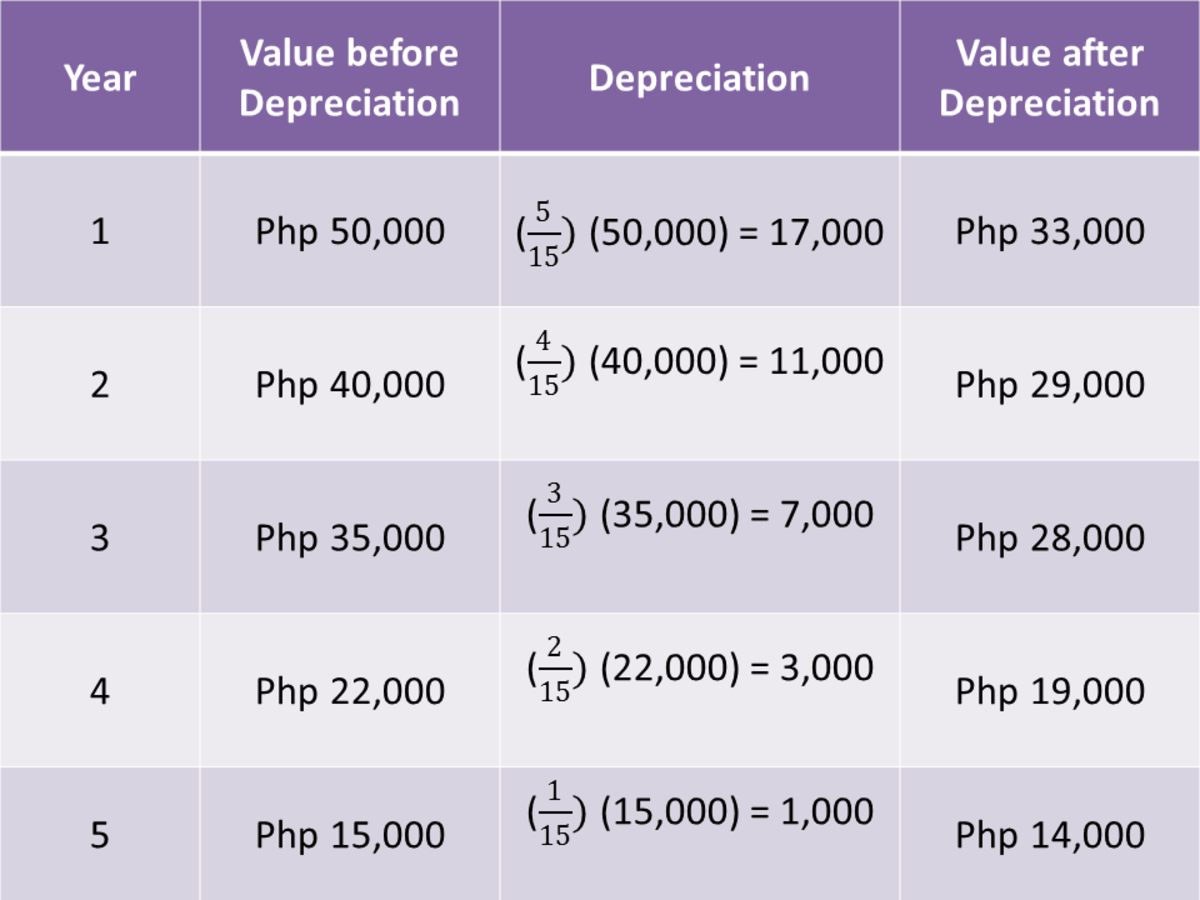

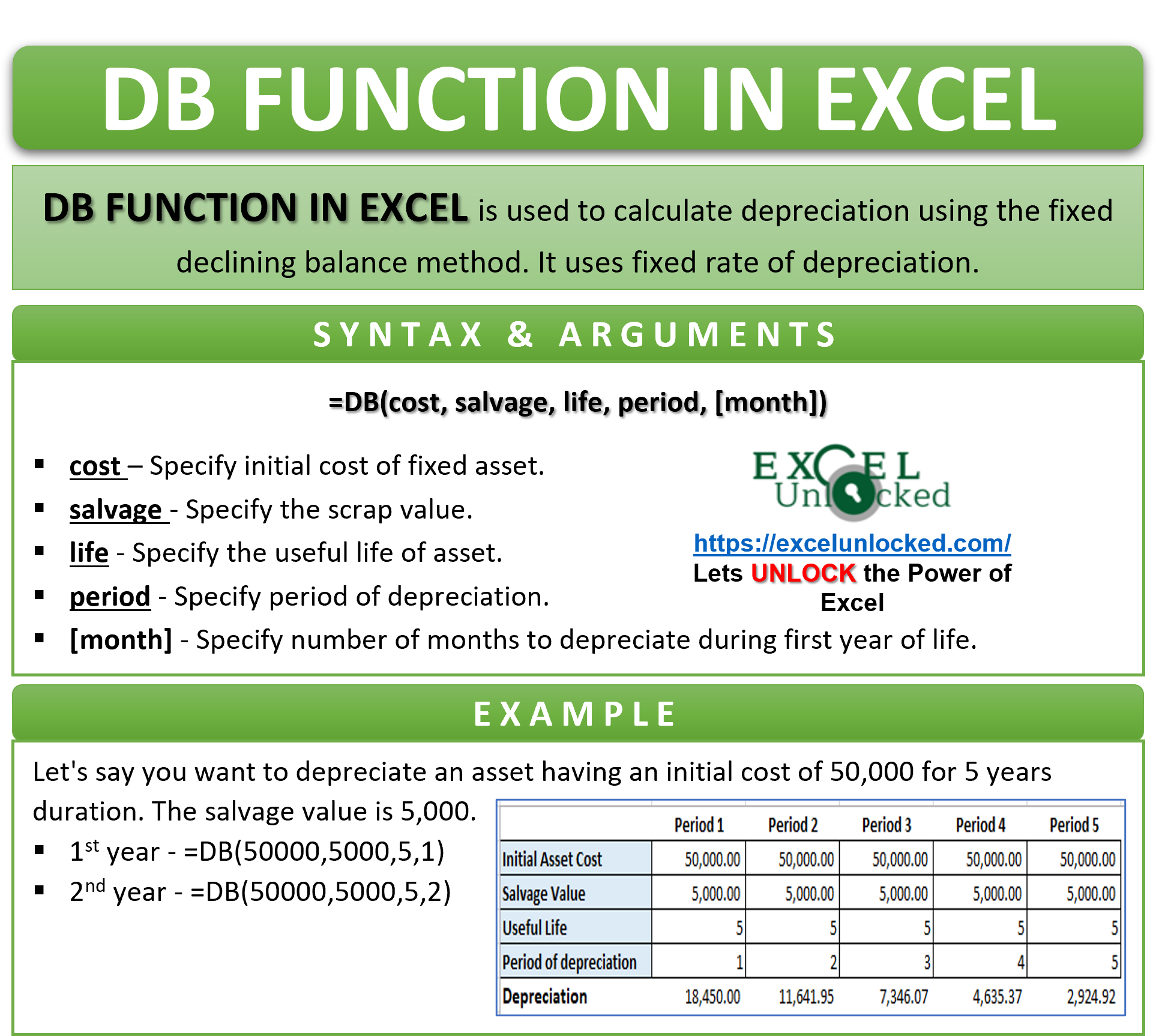

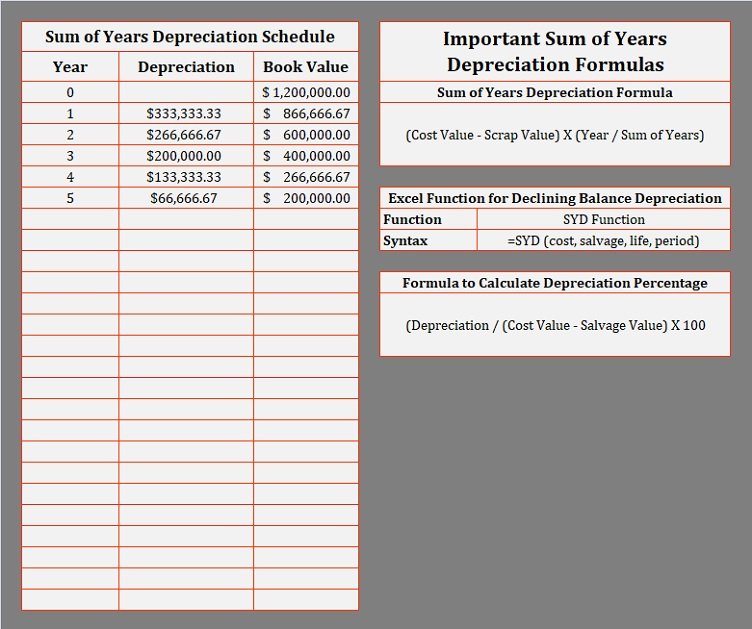

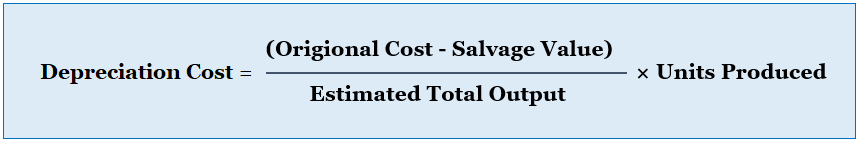

How Do I Calculate Depreciation On Residential Property ... What Is The Formula For Depreciation In Accounting? In order to calculate the straight line depreciation for the machine, the following are the costs: $100,000 for the machine. The estimated salvage value of the asset is $100,000 - $20,000, which is the total depreciable cost. The asset's useful life is five years. What is the formula for straight-line depreciation ... Subtract the asset's salvage value from its cost to determine the amount that can be depreciated. Divide this amount by the number of years in the asset's useful lifespan. Divide by 12 to tell you the monthly depreciation for the asset. How do you solve for depreciation? Determine the cost of the asset. What is depreciable cost formula? - Greedhead.net Depreciation = (Asset Cost - Residual Value) / Useful Life of Asset Under the unit of production method, the formula for depreciation is expressed by dividing the difference between the asset cost and the residual value by the life-time production capacity which is then multiplied by the no. of units produced during the period. en.wikipedia.org › wiki › DepreciationDepreciation - Wikipedia The formula to calculate depreciation under SYD method is: SYD depreciation = depreciable base x (remaining useful life/sum of the years' digits) depreciable base = cost − salvage value Example: If an asset has original cost of $1000, a useful life of 5 years and a salvage value of $100, compute its depreciation schedule.

Solved The formula for depreciable cost is Initial cost - Chegg Question: The formula for depreciable cost is Initial cost - Accumulated depreciation Depreciable cost = Initial cost Initial cost + Residual value Initial cost ...1 answer · Top answer: Ans. Option 4th Initial cost - Residual value Ex... What is the formula to calculate depreciation ... First subtract the asset's salvage value from its cost, in order to determine the amount that can be depreciated. Total depreciation = Cost - Salvage value. … Annual depreciation = Total depreciation / Useful lifespan. … Monthly depreciation = Annual deprecation / 12. … Monthly depreciation = ($1,200/5) / 12 = $20. Revised Depreciation | Calculation | Journal Entry ... The company can calculate the revised depreciation by determining the remaining depreciable cost with the formula of deducting the accumulated depreciation and salvage value at the revision date from the original cost of the fixed asset. And then divide the remaining depreciable cost with the remaining useful life to determine the revised ... What is Depreciable Value? | Formula | Example ... Please calculate the depreciable value. Depreciable Cost = 100,000 - 10,000 + 10,000 + 5,000 + 15,000 - 12,000 = $ 108,000 Depreciation Expense per Year = 108,000/5 = $ 21,600 per years VAT is excluded because the company can claim back from the tax authority or net off with VAT output, so it is not the cost.

What is the formula for depreciable cost? - Greedhead.net What is the formula for depreciable cost? The depreciable cost is the cost of an asset that can be depreciated over time. It is equal to acquisition cost of the asset, minus its estimated salvage value at the end of its useful life. What is depreciated cost?

calculators.io › double-declining-depreciationDouble Declining Depreciation Calculator - [100% Free ... The first things to know when implementing the double declining depreciation formula are the asset’s useful life and purchase price. The Purchase Price refers to the original value of your asset or the depreciable cost. The Useful Life refers to the expected time that the asset will be productive for its expected purpose.

Formula for depreciable cost? - Answers Depreciable Value = Intial Cost - Residual Value. In the US, the answer depends on what depreciable assets you are talking about.Depreciation on any depreciable asset that is directlyused in the ...

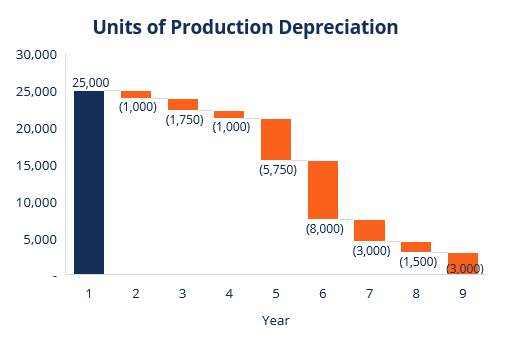

Calculate units of production depreciation | Example ... Depreciable cost per unit = Depreciable cost / Estimated units of useful life Depreciable cost can be determined by using the cost of the fixed asset deducting its estimated salvage value. Depreciable cost = Cost of fixed asset - Salvage value of fixed asset

(Get Answer) - The formula for depreciable cost is a ... The formula for depreciable cost is a. Initial Cost - Residual Value Ob. Initial Cost - Accumulated Depreciation Oc. Depreciable Cost = Initial Cost Od. Initial Cost + Residual Value

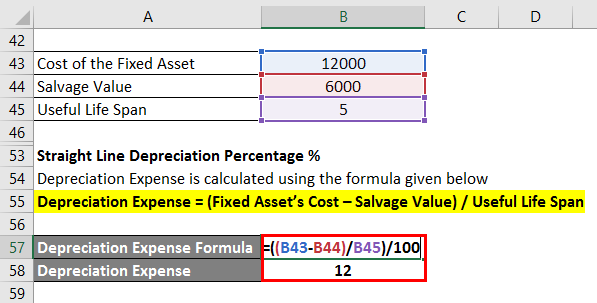

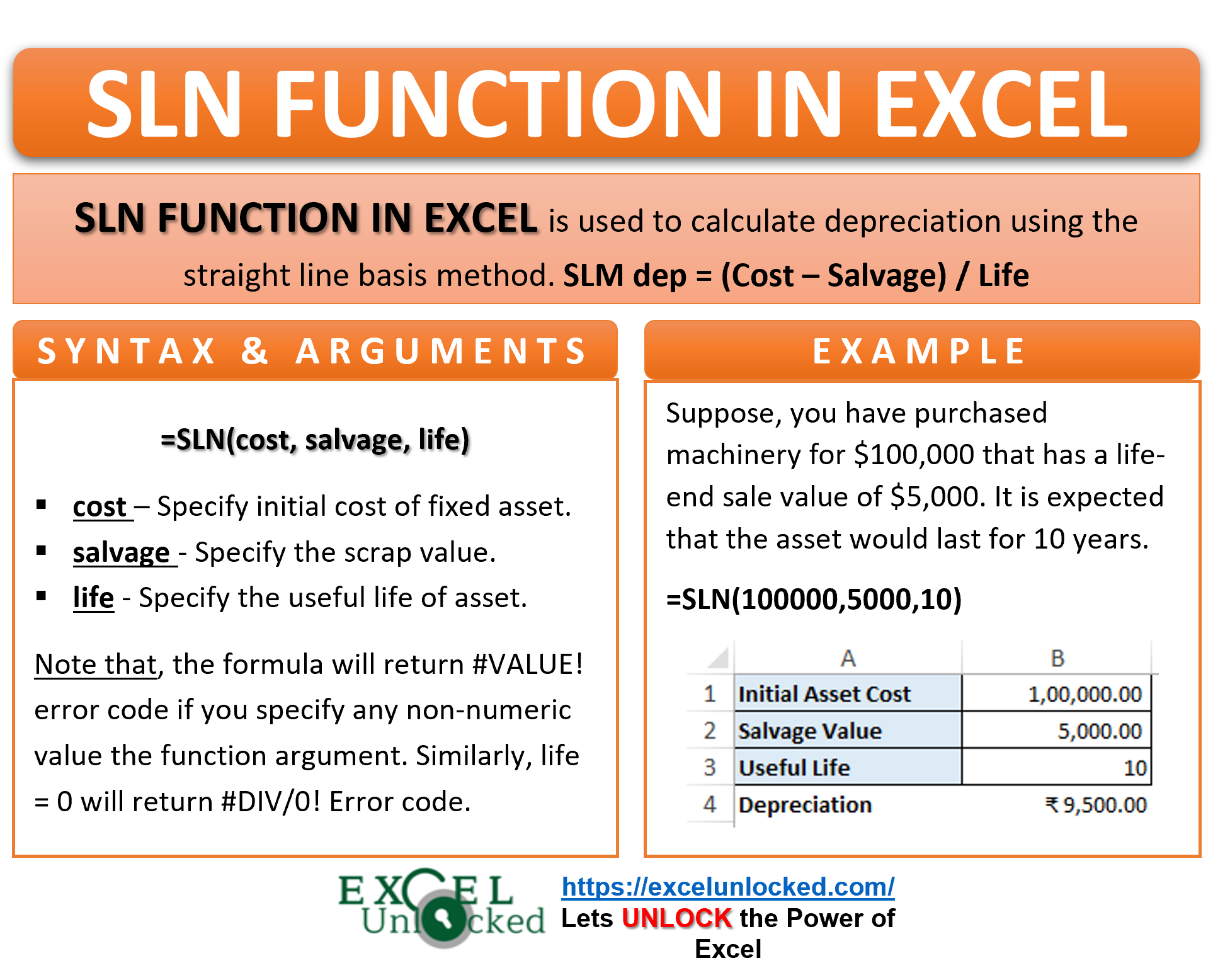

Straight Line Depreciation - Formula & Guide to Calculate ... The depreciation rate is the annual depreciation amount / total depreciable cost. In this case, the machine has a straight-line depreciation rate of $16,000 / $80,000 = 20%. Note how the book value of the machine at the end of year 5 is the same as the salvage value.

Depreciated Cost Definition - Investopedia Depreciated Cost = Purchase Price (or Cost Basis) − CD where: CD = Cumulative Depreciation Example of Depreciated Cost If a construction company can sell an inoperable crane for parts at a price...

How To Depreciate Assets Using The Straight | Simple ... Straight Line Depreciation Formula. Over the useful life of an asset, the value of an asset should depreciate to its salvage value. It is calculated by simply dividing the cost of an asset, less its salvage value, by the useful life of the asset. This is very important because we need to calculate depreciable values or amounts.

Solved > 91. The formula for calculating straight-line ... 91. The formula for calculating straight-line depreciation is: A. Depreciable cost divided by the useful life in years. B. Cost plus residual value divided by the useful life in years. C. Depreciable cost divided by useful life in units. D. Cost divided by useful life in years. E. Cost divided by useful life in units. 92.

› straight-line-depreciation-formulaStraight Line Depreciation Formula | Calculator (Excel template) Straight Line Depreciation Formula allocates the Depreciable amount of an asset over its useful life in equal proportion. The straight Line Depreciation formula assumes that the benefit from the asset will be derived evenly over its useful life.

ACCT CHAPTER 10 QUIZ Flashcards | Quizlet The formula for depreciable cost is a.Initial Cost - Residual Value b.Initial Cost - Accumulated Depreciation c.Depreciable Cost = Initial Cost d.Initial Cost + Residual Value. A. The natural resources of some companies include a.metal ores, copyrights, and supplies b.minerals, trademarks, and land

What is the formula to calculate depreciation ... First subtract the asset's salvage value from its cost, in order to determine the amount that can be depreciated. Total depreciation = Cost - Salvage value. … Annual depreciation = Total depreciation / Useful lifespan. … Monthly depreciation = Annual deprecation / 12. … Monthly depreciation = ($1,200/5) / 12 = $20.

› en › revenue-agencySelf employed Business, Professional, Commission ... - Canada Since land is not depreciable property, he has to calculate the part of the expenses connected with the purchase that relates only to the building. To do this, he has to use the following formula, explained under the heading Land. $75,000 ÷ $90,000 × $5,000 = $4,166.67

The formula for depreciable cost is a initial cost ... The formula for depreciable cost is a initial cost residual value b initial cost | Course Hero The formula for depreciable cost is a initial cost 31.

What is a Depreciable Cost? - Definition | Meaning - My ... The depreciable cost is calculated by subtracting the salvage value of an asset from its cost. What Does Depreciable Cost Mean? Notice I said cost and not purchase price. The depreciable cost is not solely based on the purchase price of an asset. Other costs like repairs, upgrades, and taxes also attribute to the cost of an asset.

salimian.webersedu.com › IEGR350 › pdfEECE 450 — Engineering Economics — Formula Sheet B= initial (purchase) value or cost basis S= estimated salvage value after depreciable life dt= depreciation charge in year t N= number of years in depreciable life Book value at end of period t: BV t = B −∑ = t i di 1 Straight-Line (SL): Annual charge: dt = (B – S)/N Book value at end of period t: BV t = B − t ×d Sum-of-Years ...

Depreciable cost definition — AccountingTools For example, a business buys a machine for $10,000, and estimates that the machine will have a salvage value of $2,000 at the end of its useful life. Therefore, the depreciable cost of the machine is $8,000, which is calculated as follows: $10,000 Purchase price - $2,000 Salvage value = $8,000 Depreciable cost

Depreciation Formula | Calculate Depreciation Expense There are primarily 4 different formulas to calculate the depreciation amount. Let's discuss each one of them - Straight Line Depreciation Method = (Cost of an Asset - Residual Value)/Useful life of an Asset. Diminishing Balance Method = (Cost of an Asset * Rate of Depreciation/100)

Solved 1.All of the following are needed for the ... - Chegg 2.The calculation for annual depreciation using the units-of-activity method is a. (Depreciable Cost/Yearly Output) × Estimated Output b. (Initial Cost/Estimated Output) × Actual Yearly Output c.Depreciable Cost/Yearly Output d. (Depreciable Cost/Estimated Output) × Actual Yearly Output 3.The formula for depreciable cost is

Ch 10 Quiz Flashcards | Quizlet Depreciable Cost = Initial Cost c. Initial Cost - Accumulated Depreciation d. Initial Cost - Residual Value d. the units-of-activity method When the amount of use of a fixed asset varies from year to year, the method of determining depreciation expense that best matches allocation of cost with revenue is a. the double-declining-balance method

Double-Declining Depreciation Formula • The Strategic CFO Jul 23 Back To Home Double-Declining Depreciation Formula. See Also: Double-Declining Method Depreciation. Double-Declining Depreciation Formula. To implement the double-declining depreciation formula for an Asset you need to know the asset's purchase price and its useful life.. First, Divide "100%" by the number of years in the asset's useful life, this is your straight-line ...

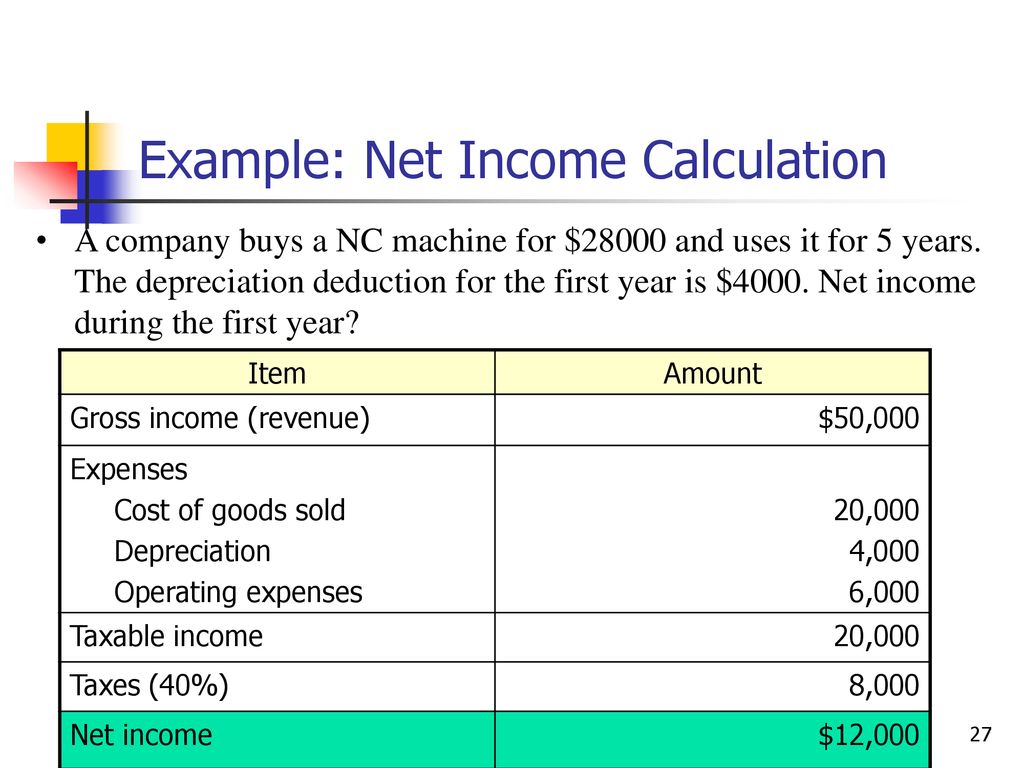

/JCPIncomestatementMay2019Investopedia-ef93846733094d2cbd1fdfe97126b3bc.jpg)

0 Response to "42 the formula for depreciable cost is"

Post a Comment